top of page

Insights on Risk, Financial Crime & Compliance

Welcome to the JFourth Solutions blog - where we explore risk management, financial crime prevention, compliance culture, and RegTech through a human-centered lens.

Combining over 50 years of frontline experience, we share practical insights for risk and compliance professionals navigating an increasingly complex landscape.

AML for Lawyers: When Legal Privilege Meets Financial Crime Prevention

Six law firms. Five lawyers. S$200,000 in penalties. The properties they helped convey were valued at over S$900 million. The fees they collected? As low as S$15,000 per firm. In August 2025, Singapore's Ministry of Law named the law practices penalised for anti-money laundering breaches connected to the country's largest money laundering case - S$3 billion in assets seized, over 200 properties confiscated, 10 foreign nationals arrested. Anthony Law Corporation: S$100,000 fi

juliachinjfourth

1 day ago19 min read

AML for Real Estate Agents: Property as the Path of Least Resistance

Two property agents. Two fines. One wake-up call. In mid 2025, Singapore's Council for Estate Agencies (CEA) penalised two real estate salespersons for failing to conduct customer due diligence on clients connected to the country's largest money laundering case. One agent was fined S$5,000 for an industrial property purchase. The other, S$2,000 for a commercial transaction. The amounts seem small. But here's what they signal: property agents are now on the frontline of financ

juliachinjfourth

2 days ago10 min read

The Gatekeeper Gap: Why Criminals Bypass Banks

S$2.79 billion. That's the total value of assets now surrendered to the Singapore state from its largest money laundering case. 10 convicted, 17 on the run. 9 financial institutions penalised, 3 law firms fined. 2 property agents sanctioned. 1 former bank relationship manager jailed for helping clients forge documents. For Compliance professionals, the real lesson isn't the scale of the crime. It's the nature of the oversight. The Real Story: A Systemic Breakdown Contrary to

juliachinjfourth

2 days ago10 min read

The Reality Check: Is Your Organisation Actually Ready for RegTech?

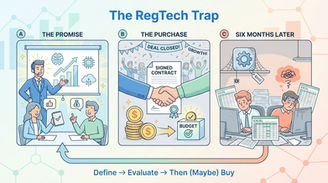

Part 5 of the RegTech Selection Series The most expensive RegTech mistake isn't buying the wrong solution. It's buying any solution before you're ready. Throughout this series, we've explored the RegTech Trap , the build vs. buy decision , how to evaluate vendors , and what makes implementation succeed . We've established that you're not buying algorithms, you're buying trust. But here's what we haven't addressed: What if you're not ready to buy anything at all? This is the

juliachinjfourth

Feb 57 min read

Making It Work: Implementation, Inclusion & Long-Term Success

Part 4 of 4 of the RegTech Selection Series The contract is signed. The budget is approved. The vendor is eager to begin. Now the real work starts. In Part 1 , we explored why most RegTech investments fail before implementation begins. In Part 2 , we tackled the build vs. buy decision. In Part 3 , we established that you're not buying algorithms. You're buying trust, and introduced the Trust Equation framework for evaluation. But even organisations that get selection right of

juliachinjfourth

Jan 297 min read

Evaluating RegTech Solutions: A Practical Framework

Part 3 of 4: RegTech Selection Done Right The demo looked perfect. The data loaded instantly. Every click worked exactly as expected. But here's what you didn't see: Perfect data, not your messy reality. Curated workflows, not your edge cases. Controlled scenarios, not your daily ambiguity. In Part 1, we explored why most RegTech investments fail before implementation begins and why the real trap is buying technology when you should be buying trust. Now comes the harder quest

juliachinjfourth

Jan 266 min read

Build vs Buy: The Decision Most Organisations Get Wrong

Part 2 of 4: RegTech Selection Done Right "We can build this ourselves." Five words that have launched a thousand failed compliance projects. I've sat in enough steering committees to recognise the pattern. The CTO leans forward, confident. The compliance team looks hopeful. The CFO is already calculating the savings. Eighteen months later, the project is over budget, half-finished, and the vendor they dismissed is now being invited back to the table. The build decision isn't

juliachinjfourth

Jan 243 min read

The RegTech Trap: Why Many Compliance Technology Investments Fail

Part 1 of 4: RegTech Selection Done Right Millions spent. Project failed. And it never stood a chance. We've seen this pattern too many times. Polished demos and impressive slide decks. Contracts signed, budgets allocated. Six months later, the team is back on spreadsheets. The failure didn't happen at implementation. It happened at purchase. But here's what most post-mortems miss: the trap isn't just buying the wrong technology. It's buying technology when you should be buyi

juliachinjfourth

Jan 244 min read

The Tide Is Turning: A Whole-of-Society Response to Financial Crime

Part 4 - Wrap Up of a Series on Payments and Financial Crime For three parts of this series, we painted a grim picture. Part 1 Part 2 Part 3 The 60-second pipeline. Fragmented ecosystems. Compliance theatre. Criminals with network effects while we operate in silos. But here's what we didn't tell you: the tide is turning. And it's not just governments and banks. It's a whole-of-society movement. The Global Signal Exchange In October 2024, something quietly significant happened

juliachinjfourth

Jan 195 min read

Safety-by-Design: The Collaboration Gap

Part 3 of a Series on Payments and Financial Crime A scam victim in Singapore loses SGD 50,000. In 60 seconds, the money moves through a local mule account and vanishes. It either buys USDT via a P2P listing to disappear into a self-custodied wallet, or it fragments into smaller amounts, hops to an e-wallet, and crosses to Malaysia and Thailand via PayNow, DuitNow, PromptPay. Two paths. One result. Four ecosystems. Four regulatory frameworks. Zero cross-border shared intell

juliachinjfourth

Jan 194 min read

When Fraud Meets Laundering: The 60-Second Pipeline

Part 2 of 3 - a Series on Payments and Financial Crime She spent three months falling in love. The money disappeared in under a minute. I keep coming back to this asymmetry. The time criminals invest in the fraud - the grooming, the manipulation, the fake platforms, versus the speed at which they move the money once they have it. This is the new reality of financial crime. Fraud and money laundering aren't separate disciplines anymore. They're a single, integrated pipeline. A

juliachinjfourth

Jan 184 min read

Why AML Can't Keep Up with Real-Time Cross-Border Payments

Part 1 of 3 - a Series on Payments and Financial Crime Not long ago, sending money across borders meant waiting days and paying hefty fees. Today, in ASEAN, the same transaction happens in seconds. Thailand's PromptPay linked to Singapore's PayNow in 2021. Similar connections now span Cambodia, Indonesia, Lao PDR, Malaysia, and Vietnam. Project Nexus promises to become the "internet of payments" for the region -a single hub connecting multiple fast payment systems across juri

juliachinjfourth

Jan 184 min read

The NPO Vulnerability Paradox: A 3-Part Series

Protecting Non-Profit Organisations Through Capability Building The very things that make Non-Profit Organisations powerful are what make them vulnerable. Public trust. Cross-border reach. Diverse funding. Community access. These strengths enable NPOs to serve those who need it most. But viewed through a financial crime lens, each one becomes a potential weakness exploited by those who would use charitable organisations for harm. This is the NPO Vulnerability Paradox . And it

juliachinjfourth

Jan 142 min read

When Criminals Exploit Good Names: The White-Washing Threat

Part 3 of a 3-Part Series on Protecting Non-Profit Organisations Through Capability Building What if the threat to your NPO isn't inside your organisation, but outside, using your good name without your knowledge? In Part 1 of this series, we explored how NPOs' greatest strengths become their greatest vulnerabilities. In Part 2 , we examined how systemic fraud can exploit programmes designed to help the vulnerable. Now we turn to perhaps the most insidious threat of all: whit

juliachinjfourth

Jan 137 min read

The Threat Has Evolved: From Terrorist Financing to Systemic Fraud

Part 2 of a 3-Part Series on Protecting Non-Profit Organisations Through Capability Building We used to worry about NPOs and terrorist financing. That threat remains real. But the landscape has shifted and many organisations haven't caught up. In Part 1 of this series, we introduced the NPO Vulnerability Paradox: how the very strengths that make Non-Profit Organisations effective - trust, cross-border reach, diverse funding, community access, also make them attractive target

juliachinjfourth

Jan 135 min read

The NPO Vulnerability Paradox: When Strengths Become Weaknesses

Part 1 of a 3-Part Series on Protecting Non-Profit Organisations Through Capability Building The very things that make Non-Profit Organisations powerful are what make them vulnerable. This paradox sits at the heart of one of the most pressing challenges facing the charitable sector today. NPOs exist to do good, to serve communities, respond to crises, and channel generosity toward those who need it most. Yet these same qualities make them attractive targets for exploitation b

juliachinjfourth

Jan 134 min read

The 2026 Compliance Landscape (Part 3 of 3)

Criminals are using AI better than most compliance teams. That's not hyperbole. That's the 2026 reality. This is the final part of our series on the 2026 compliance landscape. Part 1 covered the regulatory shift - FATF's proportionality mandate, enforcement divergence, and the 3-year cliff. Part 2 examined the liability revolution - fraud reimbursement rules, stablecoin regulation, and ESG divergence. Here's what's happening on the technology front, and why it all comes back

juliachinjfourth

Jan 66 min read

The 2026 Compliance Landscape (Part 2 of 3)

2026 is the year fraud prevention stopped being optional — and started being a liability issue. If you missed Part 1 on the regulatory shift, catch up here: https://www.jfourthsolutions.com/post/the-2026-compliance-landscape-part-1-of-3 Here's what's changing about who pays when things go wrong: 1. The Global Push on Fraud Liability 2026 marks a turning point in who pays when fraud succeeds. The UK led the charge with its mandatory APP fraud reimbursement rules, now in force

juliachinjfourth

Jan 65 min read

The 2026 Compliance Landscape (Part 1 of 3)

Half of all FCPA investigations were closed in 2025. Enforcement got easier, right? Not quite. 2026 is shaping up to be one of the most complex years for banking and compliance I've seen. Not because the rules got harder. In some places, they got softer. But because they got 𝗱𝗶𝗳𝗳𝗲𝗿𝗲𝗻𝘁. Everywhere. All at once. Here's what's shifting: 𝟭. 𝗙𝗔𝗧𝗙'𝘀 𝟱𝘁𝗵 𝗥𝗼𝘂𝗻𝗱: 𝗧𝗵𝗲 𝗣𝗿𝗼𝗽𝗼𝗿𝘁𝗶𝗼𝗻𝗮𝗹𝗶𝘁𝘆 𝗦𝗵𝗶𝗳𝘁 The February 2025 FATF Standards update replaces "c

juliachinjfourth

Jan 63 min read

A Course For Compliance and Governance | Interview with Isabelle Lessedjina Part 2

Following on from Part One of our interview with Isabelle , we discuss her upcoming training workshop in partnership with JFourth; ...

juliachinjfourth

Sep 10, 20253 min read

Protecting value and empowering people through human-centered risk and compliance design.

Book a Discovery Call

🇸🇬 Singapore | 🇲🇾 Kuala Lumpur

@ 2026 JFourth Solutions Pte Ltd

bottom of page